Florida Couple Loses Life Savings to Facebook Scam Targeting Hardworking Families

The Rise of Online Vehicle Scams and the Disturbingly Professional Tactics Used

WKMG News 6 investigative reporter Louis Bolden begins his report with a sobering warning: online vehicle scams are no longer rare, and they’re targeting “hardworking families” in ways that feel disturbingly professional. His story focuses on an Orange County couple who believed they had found the perfect vehicle through Facebook Marketplace, only to lose their life savings and watch the seller vanish without a trace.

What makes this case particularly alarming is how normal it starts. There’s no shady alley meetup or sketchy “cash only” text chain. Instead, Bolden reveals a scam that appears organized, documented, and polished—right up until the moment the money clears.

A Chevy Avalanche, A Simple Dream, And A Smooth Sales Pitch

Bolden introduces Jeffrey Kolkedy, a man who enjoys his 2002 Chevy Avalanche enough to want a newer one with similar features. He even shows off parts of the truck, talking about tool boxes and how the back comes out. That detail matters because it makes the motive relatable. This wasn’t greed. This wasn’t someone chasing a ridiculous deal because they thought they were smarter than everyone else.

Kolkedy’s search led him to Facebook Marketplace, where he believed he found the perfect match. He tells Bolden, “I found this one on the internet… 8,000 miles on it. Thought it was a great deal.” Then he describes the follow-up call, saying, “The guy called me back… he’s telling me how nice the truck is… said it’s in pristine condition.”

That’s the hook. A clean story. A clean truck. A seller who calls back quickly and talks like a professional. In scams like this, the goal isn’t always to rush you with pressure. Sometimes it’s to relax you with confidence.

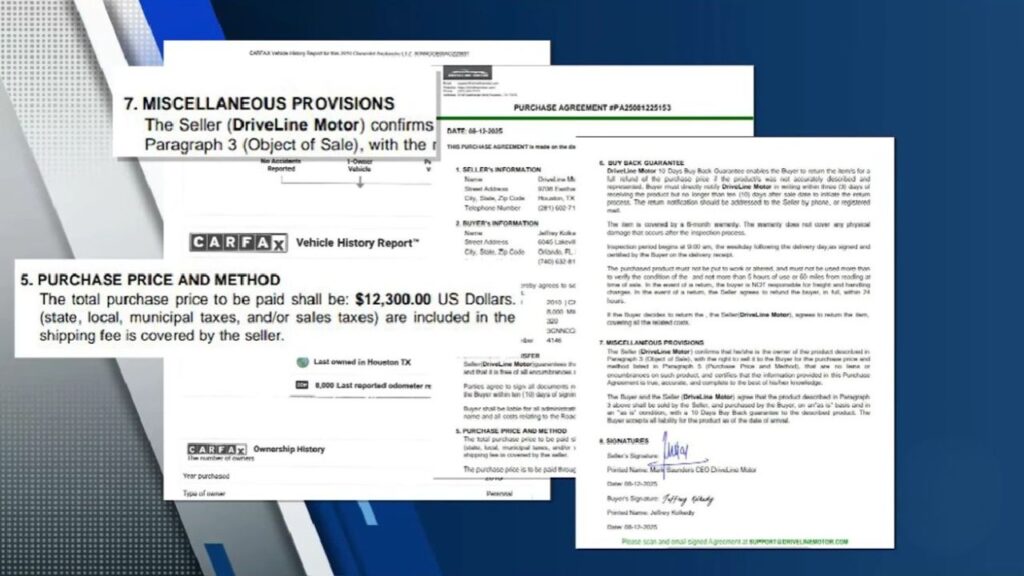

The Paperwork That Made It Feel Legit

Bolden reports that the “company” sent over a Carfax report and a purchase agreement. The seller name in the paperwork was Driveline Motor, and the sale price was $12,300, according to Bolden’s reporting. Bolden says the agreement was signed by the CEO, which is exactly the kind of detail that makes people think, Okay, this is real. This is a real business transaction.

When Bolden asks Kolkedy if he ever felt something might be off, Kolkedy answers plainly: “No.” That’s the line that sticks. Not “maybe.” Not “I had a weird feeling.” Just “No.” And if you’ve ever bought anything online, you understand how that happens. Once you’ve got a report, an agreement, and a smooth voice on the phone, your brain starts filling in the rest with trust.

The Wire Transfer That Changed Everything

Bolden reports that Kolkedy wired about $12,000. Then, almost immediately, the fraud reveals itself. Bolden says the company’s website disappeared. The phone numbers disconnected. Emails vanished. The whole operation blinked out right after the money left the account.

That’s the part scammers count on. Once a wire transfer is sent, it’s not like disputing a credit card charge. It’s closer to handing over cash and watching someone sprint away. Bolden emphasizes what that money meant to the couple. It wasn’t extra. It wasn’t “investment money.” It was everything they had saved.

Kolkedy’s wife, Susan Kolkedy, tells Bolden how deep the loss feels. “I lived my whole life, never had a savings account,” she says, adding that it was the first savings account she ever had. That’s not just financial pain. That’s pride getting crushed, too. Years of discipline, a sense of security, and that rare feeling of finally having a cushion—gone in one transfer.

The Name Trick That Fooled Them

Bolden explains a key detail that shows how modern scams work: the crooks used a business name that looked almost identical to a legitimate one. Bolden reports that the real business is Driveline Motorcars, but the scammers used Driveline Motor. That’s not a typo. That’s strategy. It’s close enough that a quick Google search can mislead you. It’s close enough that paperwork can look believable. And if the scammer sends a Carfax report and an agreement, your brain starts assuming the rest of the identity must be real too.

This is the kind of deception that doesn’t depend on stupidity. It depends on speed, distraction, and the natural human habit of assuming good faith when something looks professional.

The Bigger Pattern Behind The Story

Bolden doesn’t present this as an isolated incident. He frames it as part of a wider trend of scams built around online marketplaces and social platforms. He points to Federal Trade Commission numbers, reporting that Americans lost $12.5 billion to fraud in 2024, a 25% increase from the year before.

That detail matters because it signals something ugly: scammers are winning more often, and the methods are getting cleaner. It’s not just grandma getting a suspicious email anymore. It’s normal people making normal purchases and getting ambushed by systems designed to look legitimate.

And platforms like Facebook Marketplace create a perfect hunting ground because the listings feel familiar. People treat them like a community yard sale, but Bolden’s report shows scammers treat them like an ATM.

The Couple’s Anger At Facebook Marketplace

Susan Kolkedy directs some of her frustration at Facebook itself, and Bolden includes it as part of the emotional fallout. “Shame on Facebook,” she tells Bolden. “They shouldn’t even have a Marketplace.” That’s a raw line, and it’s easy to see why she feels that way. When a platform becomes the starting point for scams like this, victims don’t just blame the scammer. They blame the gate that was left wide open.

Now, to be fair, people can get scammed anywhere. Classified ads, random websites, even in-person deals. But Bolden’s report highlights the part that feels different here: people assume social platforms have safeguards. And that assumption is exactly what scammers quietly exploit.

BBB Advice: The Vetting Is On You

Bolden brings in Holly Salmons, president of the Better Business Bureau of Central Florida, to explain the hard truth people don’t want to hear. Salmons tells Bolden that many buyers assume social sites have protections in place to stop fraud. “They don’t,” she says. Then Salmons gets even more direct in Bolden’s report: “The social site is not going to do the vetting for you. Just because there’s a listing doesn’t mean anyone has done any sort of vetting. That’s on you.”

That might sound cold, but it’s probably the most useful sentence in the whole segment. Because once you accept that, you start behaving differently. You stop treating a listing like it’s “approved” just because it exists. You start treating it like a flyer on a telephone pole: possibly real, possibly a trap.

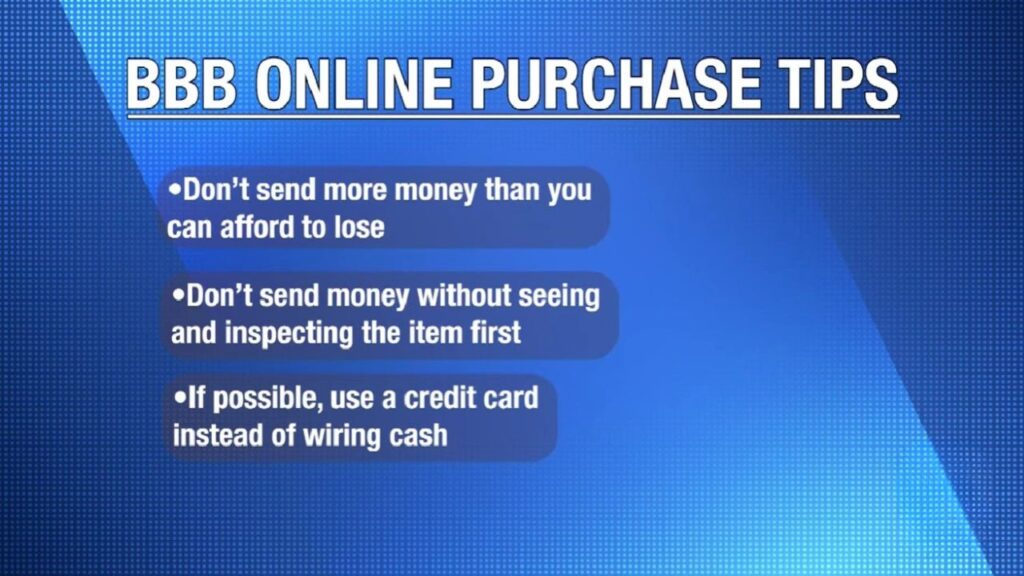

Salmons also gives practical advice through Bolden’s reporting. She says with high-ticket items, people should not send more money than they can afford to lose. She warns not to send money without seeing and inspecting the item first. And she recommends using a credit card instead of wiring cash, because wires can be extremely hard to recover once sent.

If you’re reading this and thinking, Well, yeah, obviously, that’s the point. In the moment, the obvious stuff becomes fuzzy because the scam is designed to make it feel safe.

The One Sentence That Sounds Like A Vow

At the end of Bolden’s report, Kolkedy sums up the lesson in plain language. “Now I know,” he says. “I’ll never buy nothing without seeing it again.” It’s a simple line, but it carries the weight of a harsh education. People learn lessons in two ways: cheap and expensive. This one was expensive.

And honestly, it’s hard not to feel for the couple here, because the scam didn’t just take money. It took trust. It took their sense of control.

Why This Scam Worked So Well

Bolden’s reporting shows why these schemes are dangerous: they don’t look like a scam to the person inside it. They look like a transaction. A Carfax report is a smart touch because it’s something normal buyers expect. A purchase agreement is another smart touch because it signals a “real business.” A CEO signature is a final touch because it nudges you into thinking, This company has structure. Then the scam uses the payment method that offers the least protection: a wire transfer.

The moment the money is sent, the scammer doesn’t need to keep acting legitimate anymore. That’s when the website disappears, the phone goes dead, the emails stop. In a way, it’s like a stage set. It only has to stand up until the audience buys the ticket.

Practical Takeaways People Can Use Today

Bolden’s report doesn’t just tell a sad story. It leaves viewers with a checklist—whether you realize it or not. If a deal is online, treat it like you’re investigating a claim, not accepting a promise. If the seller uses a business name, verify it independently—don’t rely on links they send you. If you can’t see and inspect the item, assume you’re taking on major risk. If the only payment option is a wire transfer, pause and ask yourself why. And if your stomach is even slightly uneasy, listen to it. A little embarrassment from walking away is cheaper than a lifetime of regret.

Bolden ends by telling viewers: “Remember, don’t fall for this game. Don’t get ripped off.” Then he adds that if someone does get scammed, they can email his investigative team at WKMG. That’s a sign Bolden isn’t treating this as a one-off human-interest story. He’s treating it like a pattern worth exposing. And it is.

Because a scam like this doesn’t need a thousand victims. It only needs a few – especially if each one is wiring away a chunk of their life.

If you shop on Facebook Marketplace or any social platform, Bolden’s story is a reminder that “legit-looking” isn’t the same thing as legit. Sometimes the cleanest scams are the ones that look like normal life – right up until the moment normal life disappears.

Posting Komentar