Jim Beam halts production temporarily

The Decision to Halt Production: A Strategic Move Amid Trade Uncertainty

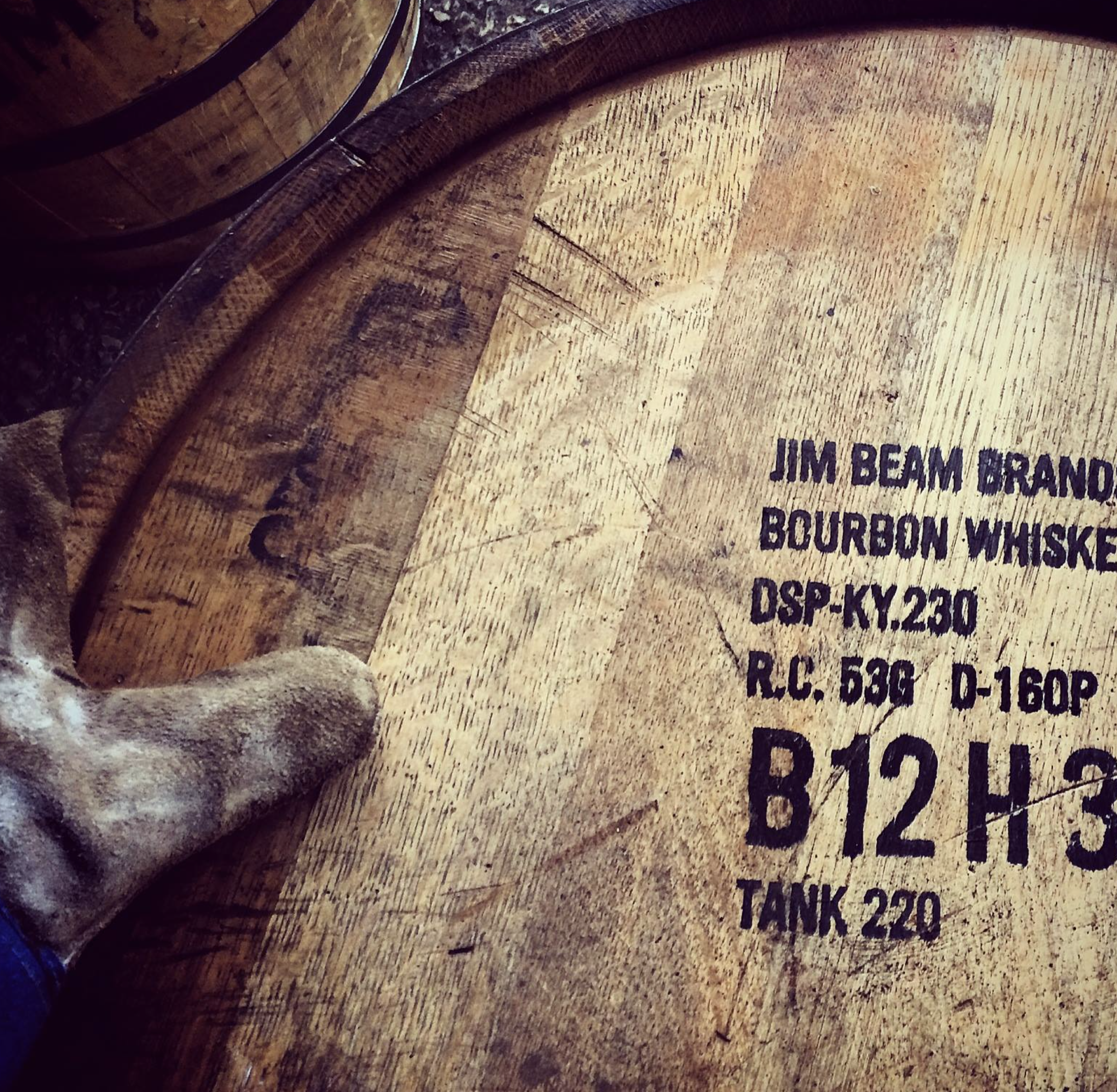

The announcement came just before the year-end holidays, a period when Kentucky customarily experiences a surge in both industrial and tourist activity. Jim Beam, recognized as the world’s top-selling bourbon, revealed a temporary halt in part of its Kentucky operations. This move, disclosed in December 2025, is not the result of declining demand or technical challenges at their distilleries but rather stems from commercial uncertainty related to international tariffs and the evolving economic policies in the United States.

According to the Associated Press, the news has been interpreted as a broader warning that exceeds the concerns of a single company. Bourbon remains a flagship product of the US industry, closely tied to Kentucky’s identity and highly reliant on global markets. The decision by Jim Beam, which is owned by Japanese conglomerate Suntory Global Spirits, to slow production signals underlying issues affecting the entire American whiskey supply chain.

A Pause Driven by Trade Policy, Not Consumption

The company clarified that the decision to suspend production at certain Kentucky facilities is not due to a sharp decline in domestic sales. In fact, bourbon consumption within the United States has remained relatively steady following the pandemic peak, and exports have served as a significant growth driver over the last ten years.

The real challenge is on the international front. Jim Beam is among the brands most vulnerable to global trade fluctuations: over half of the bourbon produced in the US is exported, with Europe, Canada, and Asia serving as key destinations. The prospect of new tariffs or the return of retaliatory duties, mainly if the US adopts a stricter stance with trade partners, has added an unpredictable volatility that is difficult to manage.

The Guardian notes that the company specifically mentioned "tariff uncertainty" as a critical factor. The concern is not only the immediate cost of import taxes, but also the inability to reliably plan pricing, distribution agreements, and production volumes in an environment where regulations can shift abruptly. For bourbon, which must age for years in barrels, producing without mid-term clarity exposes companies to significant financial risk.

Bourbon’s Significance in Kentucky and Local Impact

Jim Beam’s decision has immediate repercussions in Kentucky, a state where bourbon is much more than a drink; it is foundational to the economy. As reported by AP, the bourbon sector supports more than 9,000 direct jobs and contributes over $9 billion annually to the state’s economy, encompassing tourism, farming, transportation, and cooperage.

Jim Beam employs hundreds at its distilleries and warehouses in the state. Although the company has emphasized that the stoppage is temporary, not a permanent closure, the announcement has generated apprehension among staff, suppliers, and local officials. The pause impacts not only distillery workers, but also corn farmers, white oak barrel makers, and small businesses linked to the bourbon ecosystem.

AP highlighted that the company has chosen to reduce shifts and temporarily halt distillation in selected plants, while maintaining operations such as barrel aging and logistics. This is a defensive move: bourbon already aging in barrels will continue to mature, but the creation of new inventory is avoided at a time when market access could become more costly or complex.

Tariffs, Retaliation, and Recent Experience

Bourbon’s sensitivity to trade policy is not a new phenomenon. During the 2018–2019 trade dispute between the United States and the European Union, American whiskey was singled out for symbolic countermeasures because of its cultural and political significance. The 25% EU tariffs imposed then led to a notable drop in bourbon exports to Europe, a setback that took years for the industry to recover from.

While many of those tariffs were later lifted, their impact left a lasting mark. Distilleries realized that, despite bourbon’s artisanal and traditional reputation, the industry is exposed to geopolitical forces beyond its control. In 2025, amid heightened political volatility and renewed debates on protectionism, this vulnerability has returned to the spotlight.

According to The Guardian, the main concern extends beyond any single tariff to an environment characterized by erratic decisions, where political announcements precede technical details. For Suntory, which manages global brands and reports to international shareholders, caution dictates slowing down production rather than risking excess supply.

An Industry Caught Between Heritage and Globalization

Jim Beam’s production pause highlights a central paradox within the American bourbon sector. On one hand, bourbon is deeply local, bound by regulations requiring production in the US and aging in new oak barrels. On the other hand, its recent success is built on the global rise in demand for premium spirits, with international consumers willing to pay a premium for classic brands.

This tension becomes apparent when global trade turns unpredictable. Bourbon cannot relocate its production to avoid tariffs, nor can it quickly adjust its production cycle. Each decision made today will affect the industry years down the line, sometimes four, six, or even ten years later, once the barrels are opened.

AP reported that other distilleries are closely monitoring Jim Beam’s decision, though none have announced similar actions yet. Some are less reliant on exports or have more flexible business models. Still, all share a common concern: making whiskey means committing to the long term in an increasingly uncertain environment.

A Warning Sign Rather Than an Immediate Crisis

It is important to emphasize that suspending production does not signify a terminal crisis for Jim Beam or Kentucky bourbon. The company remains profitable, its brands have a strong domestic market presence, and current inventories ensure supply for years to come. Nonetheless, the move is highly symbolic: one of the leading icons of American manufacturing has been compelled to slow down due to the nation's own trade policies.

In this context, the decision serves as a warning not only to policymakers but also to other sectors with lengthy value chains and heavy reliance on exports. Bourbon, blending tradition, national identity, and global reach, acts here as a barometer.

The unresolved question is not whether Jim Beam will resume production; all indications suggest it will, but under which conditions, and how much confidence there will be in the commercial landscape. Should uncertainty persist, the 2025 pause might not remain an isolated event, but rather signal the beginning of an industry reconsidering its approach in an increasingly unpredictable world.

Posting Komentar